Notice regarding partial revision of the Shinsei Step Up Program

Notice regarding partial revision of the Shinsei Step Up Program(Additional conditions added to upgrade to the Shinsei Gold stage / Additional preferential services for the Shinsei Platinum stage)

From October 1st, 2018 the Shinsei Step Up Program will be revised. Please confirm the details below:

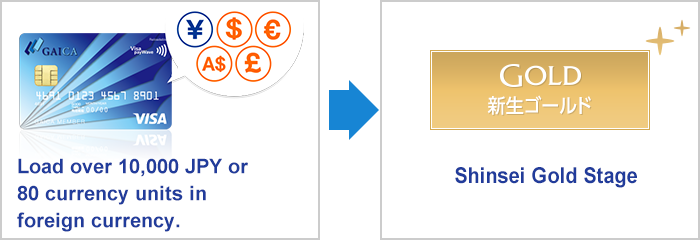

- GAICA Flex prepaid card (issued by Aplus) loads will be included as one of the conditions for Shinsei Gold.

- The 'Shinsei Family Plan' will be added to the preferential services for Shinsei Platinum stage.

Notice regarding partial revision to our domestic partner ATM withdrawal fees

What is the GAICA Flex prepaid card (issued by Aplus) ?

Load your Japanese Yen or 4 other foreign currencies from your Shinsei PowerFlex account to this card and you can make payments in Japan and overseas. (When shopping in Japan, only Japanese Yen loads can be used.) No credit check or annual fees.*1

*1 Charges will apply for reissuance of the card and for foreign currency loads.

Please click here for the details regarding the GAICA Flex prepaid card (issued by Aplus)

What is the Shinsei Family Plan ?

The Shinsei Family Plan is a new preferential service offered to Shinsei Platinum stage customers. Shinsei Platinum stage customers can register their family members' accounts (up to 2 accounts) so that their ATM withdrawal fees will be free even if they are in the Standard stage.

(Please confirm the details at a later date on our website)

Frequently Asked Questions

- Q:

- How do I load my GAICA Flex prepaid card (issued by Aplus) to meet the requirements for the Shinsei Gold stage?

- A:

- Load your GAICA Flex prepaid card (issued by Aplus) with over 10,000 JPY or 80 currency units in USD, EUR, GBP, AUD (e.g. 80 USD). (For example, in order to be eligible for the Gold Stage in October load your card with the required amount during the period of July 21 ~ August 20.) If you do not have an GAICA Flex prepaid card (issued by Aplus) please sign-up from Shinsei PowerDirect (Internet banking).

Please click here for the details regarding the GAICA Flex prepaid card (issued by Aplus)

Step Up Program

- This page has been prepared for the purpose of providing information on "Step Up Program", and not for the purpose of soliciting foreign currency deposits, structured deposits, insurance products, home mortgages, financial products trading, or financial products brokerage services.

- The eligibility requirements, services, and service period, etc. of this program may be changed or discontinued without prior notice. (The services described here are available as of September 23, 2025.)

- For more details, such as detailed terms and conditions, please check our Step Up Program brochures available in our branch or our website.

- Some products eligible for this program entail the risk of loss of principal due to price fluctuations arising from movement of interest rates, share prices, and foreign exchange rates, etc. and due to cancellation (their principal amount may fall significantly below the amount invested, depending on market trends, etc.), carry the risk of issuer's credit, or charge fees and expenses specified by each product (the amount or maximum amount of fees and expenses by product and their total amount cannot be indicated in advance as they depend on the product purchased, the amount invested, the investment performance, and the period for which the customer holds the product). Before concluding the contract, please read "cautionary notes," "pre-contract documents," and "prospectus," etc. that are available at the branch counter and online and fully understand and acknowledge risks, fees, and expenses. Customers bear full responsibility for their investment decision.