SBI Shinsei Bank has been actively engaged in real estate non-recourse finance since 2000, when Japan's real estate securitization market was still in its early stages.

We take pride in our top-tier proposal capabilities in the domestic financial industry, backed by extensive experience and a proven track record accumulated over the years.

We leverage the diverse functions of various SBI Group companies to offer optimal solutions tailored to our customers’ needs.

We also provide real estate non-recourse finance with a focus on sustainability and ESG/SDGs principles (*note).

(*note) As part of our "Shinsei Green Finance Framework" formulated in May 2020, we provide financing known as "Shinsei Green Loans" limited to projects that demonstrate a clear environmental improvement effect.

What is a real estate non-recourse loan?

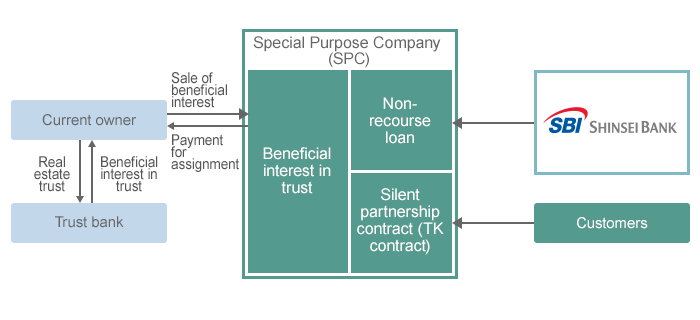

A real estate non-recourse loan is a loan secured only by specific real estate and is repaid using cash flows (rent income and proceeds from the sale of the property) generated from that collateral property. Even if the borrower fails to perform its debt obligation, the creditor's recovery is limited to the collateral. It generally uses the following structure.

When do you use a real estate non-recourse loan?

- A real estate non-recourse loan is used to satisfy the following customer needs:

- Reviewing the real estate owned for financial strategies

- Shifting from ownership to usage of real estate (sale-and-leaseback transactions)

- Acquiring real estate for investment purposes

What are its advantages?

- Improves fundraising and financial indicators through liquidation of assets owned

- Improves investment efficiency through the leverage effect

What can SBI Shinsei Bank do?

Our experience, track record and expertise in the real estate non-recourse finance business are top-class in Japan's financial industry. Our expert staff members with detailed knowledge of finance and real estate provide solutions that match customer needs by proposing the optimum structure and giving legal, accounting, and taxation advice.

What types of properties are eligible for a loan?

A real estate non-recourse loan can be provided for properties such as offices, residential properties, retail, hotels, logistics, industrial facilities, and healthcare facilities. While we generally grant a loan to a property that is already in operation, we will also consider providing development and construction loans. Loans can also be provided for multiple properties.

What assessments are conducted?

After understanding the client’s needs, we conduct our own property assessment on the location, income and expenditure, title, physical conditions, compliance and other issues concerning the property. Based on our valuations, we present the terms and conditions including the amount of loan we can offer.

What are the loan terms and conditions?

- Loan amount: The minimum loan amount is approximately 1 billion yen, but it can be negotiated.

- Period: The loan period is generally three to five years, although there is room for negotiation.

- Interest rate: There is no uniform standard. We set the interest rate depending on transaction details.

- Security: We create a security interest in the target property (including beneficial interest in real estate).

- Guarantee: Not required.

- Other: Other conditions generally include covenants on the income and expenditure situation of a property and other benchmarks.

Products and Services

- Corporate Loans

- Loan Syndication

- Loan Arrangement

- Finance for Start-up

- Real Estate Non-Recourse Finance

- Project Finance

- Infrastructure and Energy-related Finance

- Acquisition Finance

- Ship Finance

- Healthcare Finance

- Sustainable Finance/Impact Finance

Solutions